R&D Tax Credits

What are Research & Development Tax Credits?

R&D Tax Credits are a tax relief designed to encourage companies to invest more in innovation. They support businesses working on innovative projects in science or technology by allowing them to recover their eligible research and development costs in the form of a cash credit or corporation tax reduction.

Over 90,000 businesses in the UK submit a claim for R&D Tax Credits every year with the annual total value of claims now standing at over £7.6 billion.

What Work is Eligible for R&D Tax Credits?

In order to claim R&D Tax Credits, companies must be researching or developing new products, processes, materials, devices or services, or be working to improve existing ones. The R&D work carried out must be relevant to the company’s trade.

Eligible R&D projects are those in which a competent professional in the field attempts to achieve an advance in science or technology through the resolution of technological uncertainty. The company or experts in the field cannot already know about the advance or the way to solve it. The success of a project does not determine whether or not it is eligible for R&D Tax Credits.

Who Can Claim R&D Tax Credits?

R&D Tax Credits can be claimed by businesses in a wide range of sectors as long as they are undertaking qualifying R&D activities. The work that qualifies for R&D tax relief must be part of a specific project to make an advance in science or technology. Claims cannot be made for advances that are in the arts, humanities, or social sciences.

Only companies that are subject to UK corporation tax can benefit from R&D Tax Credits, however, this does not exclude those that are loss making or mean that the R&D has to have been performed in the UK (although restrictions relating to overseas R&D apply to activities undertaken from April 2024 onwards).

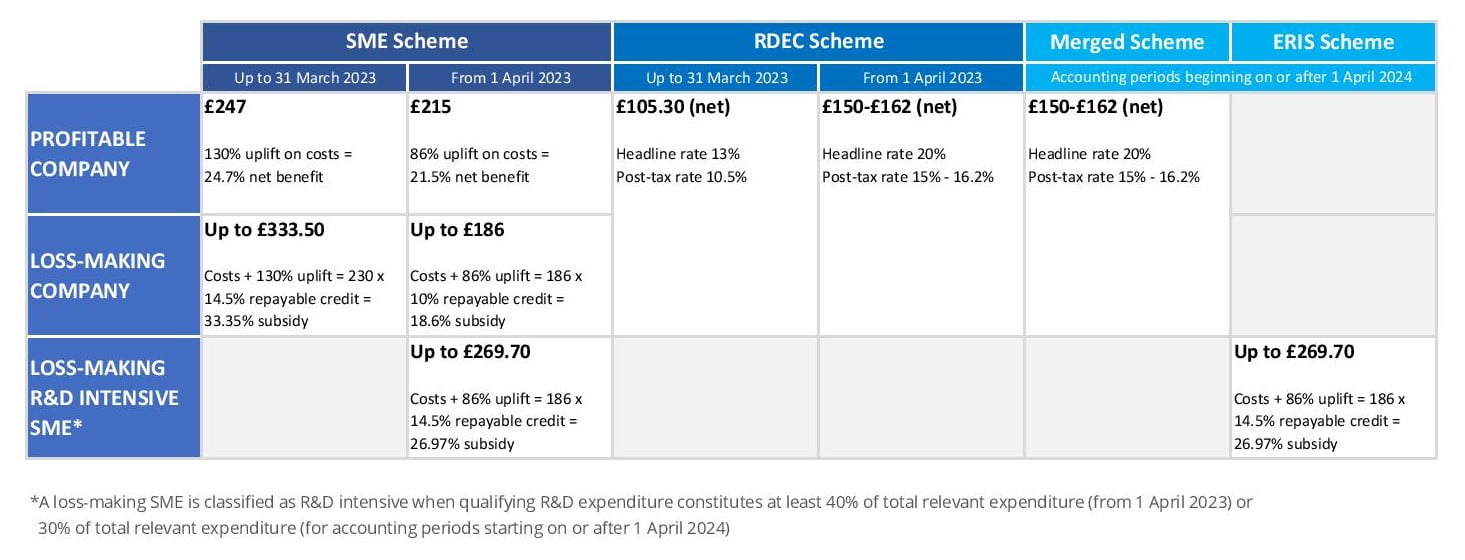

The R&D tax relief programme historically has had two distinct schemes, one for small or medium sized enterprises (SMEs) and another, known as RDEC (Research & Development Expenditure Credit) for large companies. However, the RDEC and SME schemes have now been merged into a single, simplified scheme for accounting periods starting on or after 1st April 2024. Also effective from this date, R&D intensive, loss-making SMEs will need to claim under a separate scheme with improved terms, subject to qualification criteria.

Schemes applicable to accounting periods beginning before 1st April 2024:

SME Scheme: A company is classed as an SME for R&D tax purposes if it has fewer than 500 employees (company or group) and a turnover below €100 million or gross assets of less than €86 million. A company isn’t classified an SME if it is part of a larger enterprise that when taken as a whole would fail the above test. For R&D activities undertaken from 1st April 2023, loss-making SMEs for whom qualifying R&D expenditure constitutes at least 40% of total relevant expenditure can claim a higher rate of payable credit.

RDEC Scheme (Large Companies): A company (or group) is regarded as a large company if it exceeds the SME thresholds.

Schemes applicable to accounting periods beginning on or after 1st April 2024:

Merged Scheme RDEC: Both SMEs and large companies now need to claim under this merged scheme which is available to all businesses undertaking qualifying R&D irrespective of size.

ERIS Scheme (Enhanced R&D Intensive Support): R&D intensive loss-making SMEs for whom qualifying R&D expenditure constitutes at least 30% of total relevant expenditure can claim a higher rate of payable credit under this scheme.

What is an R&D Tax Credits Claim Worth?

The R&D tax relief schemes have recently seen the biggest changes since they were introduced in the UK over 20 years ago with a range of reforms, amended rates and new compliance measures being introduced.

In the short term this makes the process of claiming R&D Tax Credits more complex as businesses need to ensure their claims comply with the specific guidelines and rates applicable to the accounting period for which they are claiming.

Below is a basic overview of the different rates, schemes and dates they apply. A number of factors can affect the amount of relief due including a company’s taxable profit level and the rate of corporation tax they pay.

R&D Tax Credit claim values for every £1,000 spent on eligible R&D:

To calculate the amount of R&D Tax Credits you are due, take the value of your qualifying R&D expenditure and increase it by the relevant rate to give your ‘enhanced expenditure’ figure.

For profitable companies, your enhanced expenditure is deducted from your taxable profits to reduce the amount of corporation tax you need to pay. If the total of your enhanced expenditure is higher than the amount of your taxable profits, it will result in a taxable loss which can either be carried-forward, carried-back or surrendered for a payable R&D Tax Credit.

For loss-making companies, your enhanced expenditure increases your taxable loss which can either be carried-forward, carried-back or surrendered for a payable R&D Tax Credit.

Eligible R&D Expenditure

There is a wide range of qualifying expenditure applicable to a claim for R&D tax relief including but not limited to:

- Consumable items

- Clinical trials volunteers

- Data licence and cloud computing (effective from 1st April 2023)

- Externally provided worker costs

- Staff costs

- Software

- Subcontractor costs

Retrospective R&D Tax Credit Claims

Whether you’re profitable or loss-making, it’s also possible to retrospectively claim for R&D projects undertaken during your previous two accounting periods.

How to make a Claim for R&D Tax Credits

In order to claim R&D tax relief, you first need to identify which of your projects and activities meet HMRC’s qualifying criteria. You then need to ascertain which of your expenditure is directly attributable to R&D, noting that R&D starts when work begins to resolve scientific or technological uncertainty and ends when that uncertainty is resolved, or the work to resolve it stops.

Once you have your eligible expenditure figure, you can then calculate your enhanced expenditure at the applicable rate of relief. This is the figure you need to enter into the full Company Tax Return form (CT600). If you make a trading loss, you can choose to surrender this and claim a payable tax credit. In this case you will also need to complete the supplementary form CT600L.

If your claim covers more than 12 months, you will need to submit a separate claim for each accounting period. You can make a claim up to 2 years after the end of the accounting period it relates to. Note that for accounting periods beginning on or after 1st April 2023, you may need to pre-notify HMRC of your intention to submit a claim.

As of 8th August 2023, an additional information form must be completed and submitted to HMRC, prior to the submission of the company’s corporation tax return. It is now a mandatory requirement for businesses to complete this form in support of each claim. Those not adhering to this process will have their claim rejected by HMRC.

Companies can choose to submit a claim themselves, outsource it to their accountant, or employ the services of a specialist third party such as R&D Funding Group.

The key to maximising a claim is in the identification and justification of qualifying costs and activities and this is where a specialist can really make a significant difference to the amount of tax relief you are able to obtain.

Why Use R&D Funding Group to Handle your Claim?

Adding significant value

Preparing and submitting a claim for R&D tax incentives can be complex and time-consuming, particularly for those who are unfamiliar with the process. Seeking specialist professional advice can add significant value to any potential claim, and this is particularly pertinent if you are considering other tax incentives or grant funding as this can negatively impact on your claim value if not managed correctly.

Taking

ownership

With our specialist knowledge and experience of putting together R&D claims, we can take ownership of the process for you. We determine precisely what you can claim for, ensuring your claim is maximised and strictly HMRC compliant. We write technical reports that provide sound supporting evidence and that R&D tax inspectors will approve. We have an outstanding relationship with HMRC and will fully defend your claim in the unlikely event there is a query with it.

Qualified & experienced

We regularly attend and contribute to HMRC’s Research & Development Communication Forum and update our clients and associates on the latest and proposed developments within the industry. Every member of our team has between 10-15 years’ specialist experience handling R&D Tax Relief claims, backed by formal qualifications and industry experience.

Your claim will be handled by our Industry Specialist Technical Consultants and R&D Tax Specialists

We require just two to three hours of your time at the start of the process to gather all the relevant information, allowing you and your staff to then focus on your core business.

In brief summary we will:

- identify all of your R&D projects, activities and costs

- write up your technical report

- prepare your costing schedule

- work in conjunction with your Accountants to file the claim

- ensure HMRC handles your claim quickly

- deal with any queries raised by HMRC and fully defend your claim to ensure it’s accepted

- handle your R&D claim from start to finish

Saving You Time and Money

As experience has proven we are able to maximise claims by significant sums compared to those prepared in-house or by Accountants, our service not only saves you time but provides you with a higher return.

All of our R&D Tax Credit claim work is carried out on a contingency basis so you only pay us a fee on receipt of your successful claim (a percentage of the corporation tax saving). There are no hidden costs or charges so there is no risk to you in engaging our services. In the unlikely event your claim is unsuccessful you will pay us nothing and the work done by us in preparing and submitting your claim will be free of charge.

For a free, no-obligation R&D Tax Credits consultation, contact R&D Funding Group today:

Call us on 020 3603 2096

Email info@rdfunding.co.uk

or complete and submit this short form: